fha loan hawaii guide for island homebuyers

What to expect

Buying in Hawaii blends stunning scenery with unique rules. An FHA loan can open the door with a down payment as low as 3.5% for credit scores 580+, plus flexible underwriting that helps first-time buyers compete in high-cost markets.

Key details

Loan limits vary by county-Honolulu, Maui, Kauaʻi, and Hawaiʻi Island-so check the current cap for your target area. Expect both an upfront and annual mortgage insurance premium, and remember condos must be on the FHA-approved list. Leasehold property, lava and flood zones, and hurricane coverage can affect eligibility, appraisal, and insurance costs.

- Typical DTI guideline near 43% (higher possible with strong compensating factors)

- Seller credits up to 6% may cover closing costs

- Gift funds allowed with proper documentation

- Two years of employment history and verifiable income

How to prepare

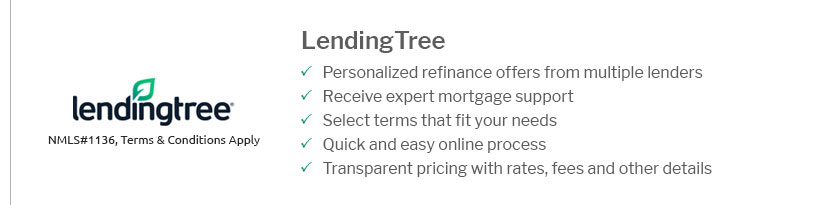

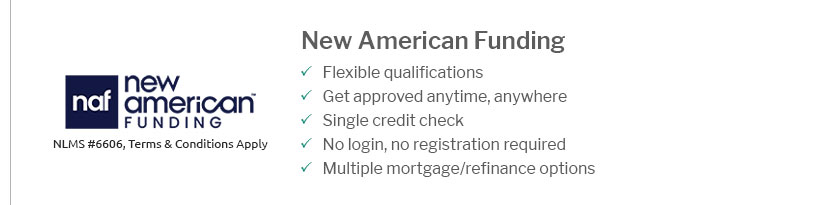

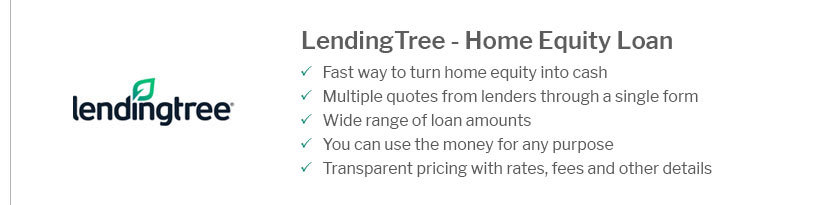

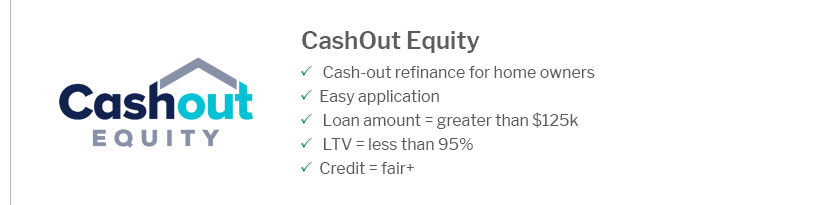

Get preapproved, compare lenders’ rates and MIP policies, and confirm your property type qualifies. Gather pay stubs, W‑2s, and asset statements, and price homes with taxes, HOA dues, and hazard insurance included. A savvy local agent and lender can help you time offers and navigate tight island inventory.