|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding FHA Loans in Hawaii: A Comprehensive AnalysisThe Federal Housing Administration (FHA) loan program is a crucial financial instrument for many potential homeowners, particularly in unique and high-cost areas like Hawaii. FHA loans are designed to help borrowers who may not qualify for conventional mortgages due to lower credit scores or smaller down payments. In Hawaii, where the real estate market presents both opportunities and challenges, these loans serve as a pivotal option for many residents. Advantages of FHA Loans in Hawaii

Challenges Associated with FHA Loans in Hawaii

Conclusion: Balancing Benefits and Drawbacks FHA loans in Hawaii offer a viable path to homeownership for many individuals who might otherwise struggle to secure financing. The program’s benefits, such as lower down payments and more lenient credit requirements, are significant, particularly in a market characterized by high property prices. However, potential borrowers must also weigh the costs, such as mortgage insurance premiums and possible property limitations. For those considering this option, it is advisable to consult with knowledgeable real estate and mortgage professionals who understand the nuances of the Hawaiian market. Ultimately, FHA loans represent both an opportunity and a challenge, reflecting the complex dynamics of purchasing a home in Hawaii. https://www.lendingtree.com/home/fha/fha-loan-limits-in-hawaii/

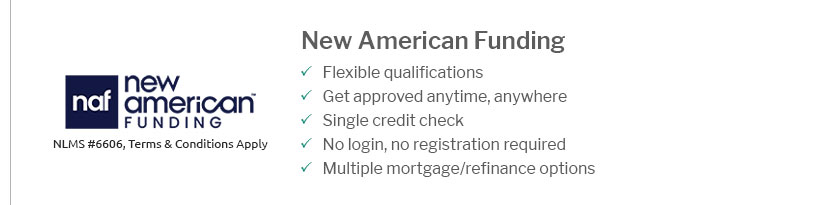

While loan limits vary based on county, FHA loans ensure homebuyers have access to affordable financing options in low and high-cost areas. In ... https://www.newamericanfunding.com/loan-types/fha-loan/state/hawaii/

To qualify for an FHA loan in Hawaii, you must meet the above requirements. You must have a credit score of at least 500. Your DTI must be less than 57%. You ... https://pacifichomeloans.com/fha/

Some Benefits of an FHA Loan: ... In 2023, the FHA lowered many of the monthly mortgage insurance premiums. ... Minimum down payment of only 3.5% ...

|

|---|